Mortgage Payoff Experiment

Should you pay off your mortgage early or invest?

I get this question a lot (twice in the last week, actually).

One year ago, a reader named Clay bought a new house and had to make this exact decision.

Note: You may remember Clay from this 2015 post – Financial Independence After Tragedy

Lucky for us, he decided to do a bit of both and he’s tracked all his numbers to compare the two options!

Clay doesn’t have his own blog so he kindly reached out to me to share his findings.

Obviously your investment returns will differ and you can’t predict what the markets are going to do in any given year but it’s interesting to see how the numbers in this real-life experiment are playing out.

Take it away, Clay…

You’ve read all the articles and heard all the debates.

The “All Debt Is Evil” camp declares…

“Payoff the mortgage as fast as possible! Your damn hair is on FIRE! Debt is the spawn of SATAN! Once the house is paid off you will have enormous cash flow! Pay it off! PAY IT OFF!!!!”

The “Smarter Than Thou” finance ninja will tell you…

“Mortgages are GOOD DEBT! Investments are the way to go. Borrow at 4% and earn 7% in the market! It is simple math you moron. Plus tax law is in your favor. Don’t put your money in the house…put it in investments.”

The decision between mortgage payoff and investing is really about balancing the psychology of living debt free with your own personal risk tolerance (with an extra side dish of finance efficiency).

This past year I found myself in a situation where I could run an actual test, with actual money, on my actual house.

Last year my wife and I bought a house for our newly blended family. When my old house sold, we had enough cash to pay off our new mortgage.

So I had a few choices…

OPTION (1) Pay off that mortgage, burn that bank statement, and invest that extra cash each month. Dave Ramsey would be proud.

OPTION (2) Keep my newly minted 30-yr mortgage and stick the funds from the old place in 100% stocks and watch CNBC for hours each night since I will no longer be able to sleep.

What to do, what to do?

How about a compromise that gives a sense of security and still leaves funds in the market? Wouldn’t that be sweet? Isn’t all personal finance personal? So why not do a little of both?

Step one, pay off a portion of the mortgage to bring it down to $200k. This is a nice round number and the reduction of principal shrinks the 30-year term to just over 16 years. Now, I’m paying more in principal than interest each month AND I have a bunch of equity in the house. All this makes me feel better. MATH BE DAMNED!

Step two, take that same nice $200k round number and invest it.

Where should it go? VTSAX? Yeah, maybe I would do that if it were the Mad Fientist’s money but this is my own scratch we’re talking about here. This is not just theory, I am actually doing this. So a nice blended fund that generates income would be perfect. I want to have the income from this fund go directly into my checking account instead of being reinvested, because hey, I am sort of semi-retired at this point and care about having some income. Plus there are these things called mortgage payments I still need to make.

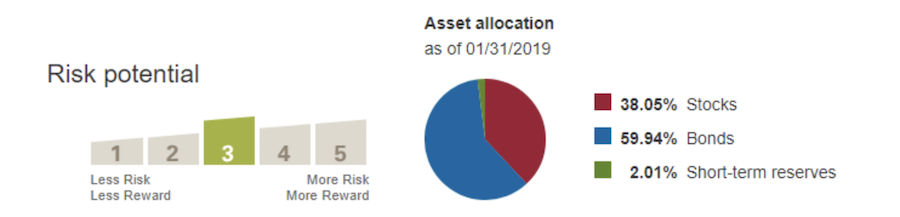

I ended up landing on the Vanguard Wellesley Income Fund Admiral Shares ( VWIAX), which is an income-based balanced fund.

Yes I could have gone more aggressive and yes I could have re-invested the distributions but hey…this ain’t no disco…this ain’t no foolin’ around. I still need to make sure that my wife and I can sleep at night and the combination of regular income in a balanced fund gives me the confidence that I’m still putting my greenback soldiers to work in a responsible way.

So here we go…

As of June 2018, there are now two competing line items in my spreadsheet:

Investment

$200k into VWIAX fund (3,148.119 shares @ $63.53).

This has a historic market gain of 6.8% according to Vanguard and pays quarterly dividends.

The value will change with the market.

Mortgage

$200k at 3.99% with term of 16 years 8 months.

Monthly P+I is $1368.53. The amount owed steadily goes down as it is paid off.

Results

How do we compare?

Unlike watching two racers who would deftly maneuver and muscle for rank, trying to compare paying off a mortgage to a stock fund in real-time isn’t as easy as you’d think.

Compare the Balances

Don’t you just compare the fund balance vs. mortgage balance? Duh. What could be simpler?

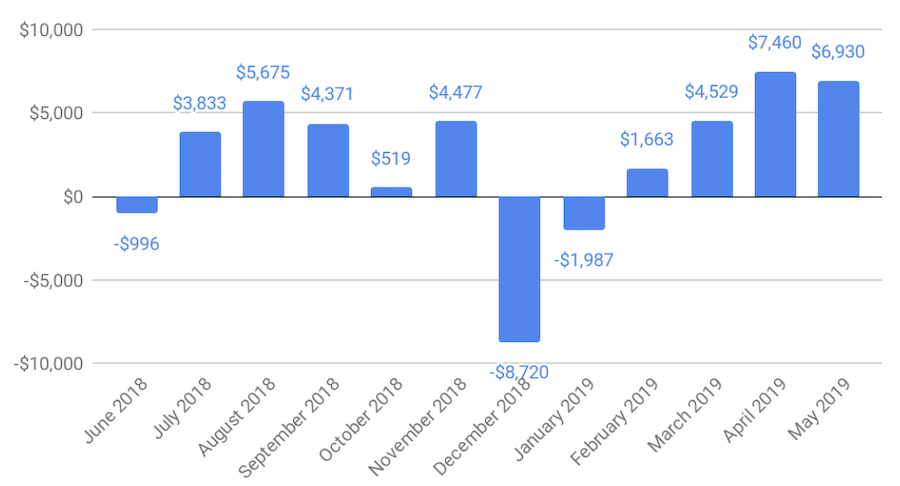

Every month, the mortgage shrinks and the fund bounces up and down with the market. I can just compare the balance between the two. If I subtract them I get what I call the “What if I just pay off the mortgage?” graph.

This is what is left in my greedy hands if I cashed out the fund and paid off the mortgage.

For example at the end of June the fund was worth $198,300.01 and my mortgage was $199,296.47. So if I wanted to cash in the fund and pay off the mortgage, I’d need to come up with an extra $996. Wait, what’s that now? I need to pay $996? Oh crap! Terrible decision!

However, by the end of August, I’d have an extra $5,675 in my pocket so therefore I’m a genius. Fantastic decision.

In December the market goes bananas and I’m out eight grand. Again, terrible decision! Wow and this fund is 60% bonds? Can my risk tolerance withstand this volatility?

Not so fast, what about the income generated by the fund?

Investment Income

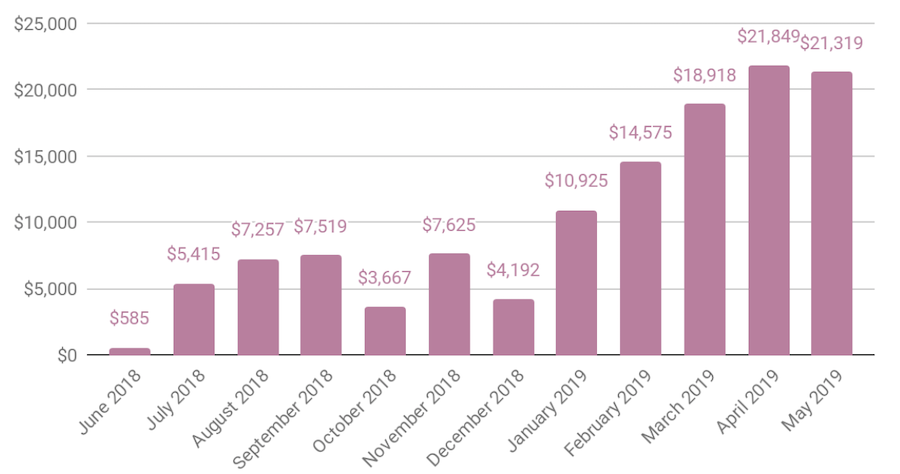

Let’s not forget that the fund pays out dividends and capital gains, which go right into my bank account.

So far the fund has paid my lazy butt $14,389, which has turned out to be a pretty decent income stream.

June 2018 September 2018 December 2018 March 2019 TOTAL $1,581.93 $1,566.19 $9,764.21 $1,476.78 $14,389.11

December was a bit of a Christmas surprise with higher than expected capital gains.

It looks like the fund is crushing it even with that downswing in the market. We need to make sure the income gain is considered in the comparison.

Looks like I’m up over $21 large. Anything else to consider?

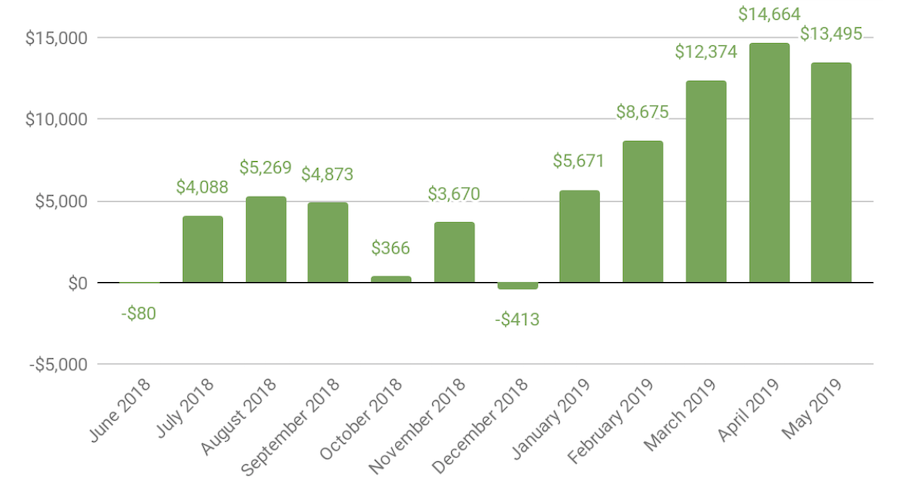

Aha! You need to subtract the interest paid on the mortgage.

Interest Paid

Every month I’ve got to make a P+I payment to The Man (in this case “The Man” is actually Suntrust Mortgage).

The “P” part of the equation is principal towards equity in the house so I can safely ignore that for this comparison but that pesky “I” stands for interest.

Every month a slightly smaller portion of my mortgage goes towards interest. However, it still adds up.

Over the first year that interest will be $7,823.89 so I need to subtract out those pesky interest payments made for the privilege of using the bank’s money to buy the house.

Taxes

What about taxes?

I’ve purposely left out the tax considerations here.

Historically, tax policy favored keeping the mortgage. However, with recent changes, deducting mortgage interest isn’t the slam dunk it used to be.

There are also taxes that need to be paid on the dividend and capital gain income from the fund. However, that rate greatly depends on other income so for this comparison, I’ll just keep life simple and leave both rates at zero.

Results

After one year the winner is…the fund by $13k!

I think this has shown what we all already know…the math favors investments over a mortgage payoff.

Even this very conservative, income-driven fund is outperforming the mortgage.

However, for many, the psychological benefit of having a paid off home is worth leaving some money on the table.

Trust me, I get it.

For me, having a reliable fund at my disposal that I could use at any moment, for any reason, has some psychological benefits as well.

A paid-off house is great but the only way to get the money out of that house is to either sell or take a loan.

You know what else is great? Having an investment fund at my immediate disposal, especially since it’s also throwing off some income.

Future Plans

What does the future hold?

I’m not sure. Right now I see no reason to change anything and I enjoy tracking the fund performance on a monthly basis so I’ll probably keep this little horse race plugging along for many years to come.

Talk to me after a solid three-year bear market and maybe things will have changed but that is why I chose the type of fund I did.

If my wife and I decided to quit working altogether, we could decide to pay off the mortgage to simplify our finances. However, the fund comes pretty darn close to making the P+I payments for me.

No matter what I choose, I’ll still end up with a paid-off house.

If I stay the course for 16 years and assume a conservative 5% return with 3% income yield, I’ll have a paid off house PLUS a fund that is worth $434k.

Additionally, I will have syphoned off $155k worth of dividends over those years, while paying $74k in interest payments, for a net income of $81k.

All this for NOT paying off my mortgage!

Want to see the raw numbers? My tracking spreadsheet can be viewed here and I update it regularly.

Thanks very much, Clay!

Seeing real-life numbers really helps highlight the differences between the two options.

Although I’d likely go the full investing route myself if I owned a house (especially since interest rates are currently so low), this decision ultimately boils down to a personal choice that you need to make based on your own risk tolerance.

Clay’s hybrid approach seems like a good compromise though, especially since the income from the fund almost covers his entire mortgage payment!

Experiment Updates

Clay plans to update his spreadsheet monthly so keep checking back here to see how the experiment progresses.

Big thanks again to Clay for sharing such an interesting and well-executed experiment and hopefully it helps you decide what to do when you face this same question!

Related Post Financial Independence After Tragedy

A reader named Clay goes under the microscope and shares his story of pursuing financial independence after tragically losing his wife.

The post Mortgage Payoff Experiment appeared first on Mad Fientist.

Lifehacker

Lifehacker