Why You Should Form an S Corporation (and When)

When I started the Mad Fientist, I didn’t do anything special to start my “business”.

As I mentioned in my last post, I was sick of being paralyzed by stuff that didn’t really matter so I just started writing and didn’t stress about the business end of things.

I kept track of my business expenses in a spreadsheet and when tax time rolled around, I just filed a Schedule C for my Sole Proprietorship and used those business expenses to reduce my W-2 taxable income.

It wasn’t until 5+ years after starting this site that I actually formed an LLC and started filing my taxes as an S Corporation.

Why did I make the change after so many years? What are the benefits that prompted me to do it?

That’s what this post is about.

My last article described why I think everyone should start a business and this post explains the benefits of forming an S Corp once your business becomes more profitable.

To assist me with this article, I brought back the tax mastermind who helped me switch my own business over to an S Corporation – my personal accountant, Steve Nelson!

Steve knocked it out of the park with his last guest post ( Section 199a – The Tax Break of the Century) so I figured he’d be the perfect person to come back to talk about this complicated business tax stuff.

Welcome, Steve!

Okay, a warning. The S corporation tax strategy requires a bit of fiddling. For many small businesses, the strategy won’t make sense.

But for some self-employed folks, the S corporation option easily adds a six-figure chunk to your net worth.

Accordingly, the Mad Fientist thought it made sense to cover this tax-avoidance topic before the year ends.

The paragraphs that follow go over the accounting, discuss the costs, and then point out the steps to take if you want to do this.

Understanding S Corporation Tax SavingsTo understand how an S corporation saves tax, you need to look first at the way a sole proprietor’s self-employment earnings get taxed.

Take the case where a sole proprietor earns exactly $100,000.

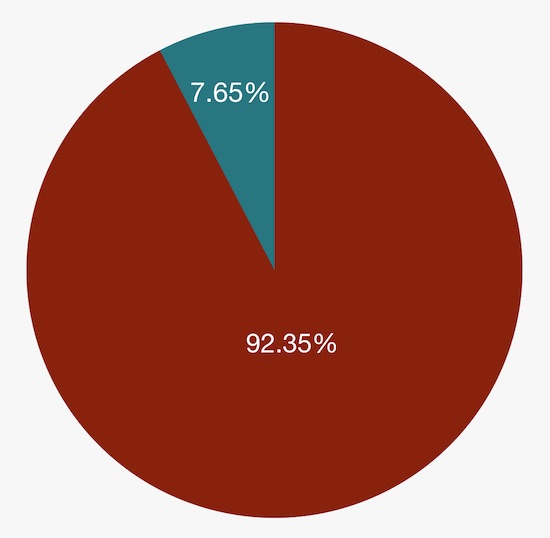

Assuming this person doesn’t have another job, the self-employment taxes equal 15.3% of 92.35% of the $100,000 of profits.

Percentage of Profit Subject to Self-Employment Taxes – Sole Proprietorship

That means this person pays about $14,130 in self-employment taxes.

Note: Self-employment taxes replace the Social Security and Medicare taxes that employees pay and basically work the same way.

However, suppose this person incorporates their sole proprietorship and makes an S election. In this case, the business needs to call out a chunk of the profit as wages. And in this case, that 15.3% tax (now Social Security and Medicare taxes) only applies to the wages.

If the wages number equals $40,000, for example, the employment taxes equal 15.3% of the $40,000.

Percentage of Profit Subject to Employment Taxes – S Corp

And this means the person pays about $6,120 in employment taxes.

You see the roughly $8,000 of savings: $14,130 vs $6,120…that’s the S corporation strategy in a nutshell.

The Flip Side of the S Corporation CoinObviously, the S corporation tax strategy delivers substantial tax savings. Annually. But the savings come with extra costs and risks.

For one thing, both the federal and state governments levy additional payroll taxes on the $40,000 of wages that they don’t levy on sole proprietorship profits. That’s often about $500 a year.

Further, an S corporation burdens you with additional tax accounting. You might decide to just learn the law and do this yourself. Or you might outsource the work to some accountant.

In either case, that extra accounting costs time or money or probably both (as a guess, maybe another grand for a small S corporation if you outsource the work?).

Nevertheless, an S corporation often saves substantial sums.

You’re talking low to mid six figures for many FIers but for folks who work longer, the future value “S corporation” benefit probably grows into seven figures.

The Reasonable Compensation RiddleLots of people use the S corporation gambit (maybe around six million folks but recent IRS data is sketchy).

But you have a big riddle to solve if you want to do this. That riddle…what wages do you pay yourself as the business owner?

To maximize your savings, you want to pay yourself as little as possible. Peanuts, ideally.

But the IRS says (and courts agree) that you need to pay something reasonable. Reasonable means what a similar employer would pay an employee for doing equivalent work.

I will tell you this..the average S corporation generates about $90,000 of profit for an owner and calls about $40,000 of this profit “wages” (this breakdown lines up pretty neatly with the earlier example).

But what you need to do is identify a reasonable compensation amount—and then document your logic.

Dirty LaundryWe’ve got a longer write-up on the setting reasonable S corporation salaries here at my blog: S Corporation Reasonable Compensation.

But we should have the “awkward talk” at this point. Regularly S corporation owners go ape when setting their salaries.

They don’t, for example, set the salary to some reasonable level. They set a salary artificially, often absurdly low.

The Treasury Inspector General in past has reported that tens of thousands of S corporation shareholders pay themselves zero salary. And in that case, they avoid paying any self-employment taxes.

Presumably, hundreds of thousands of S corporation shareholders pay more than zero but still unreasonably low salaries.

But you don’t want to do that. You really don’t.

If you set your salary too low, the IRS can reclassify distributions paid to shareholders as wages and then slap you with penalties.

And here’s the other thing to keep in mind. You don’t have to go crazy or break the rules.

How Optics Matter to Reasonable CompensationConsider again the earlier example where someone makes $100,000 but pays $40,000, or 40%, in wages.

Okay, maybe that works for some taxpayers. And it meshes with the averages pretty well. But that breakdown may be unreasonable.

Yes, many taxpayers get away with this. The IRS audits about 12,000 S corporations a year, and nearly 6,000,000 S corporations exist.

If you’re paying the average, you are pretty boring to the IRS’s computers.

However, what you really ought to do in a situation like this?

Dress up the optics of the tax return. And people use two tricks here…

Trick One: Nontaxable Fringe BenefitsTrick one? Add nontaxable fringe benefits like health insurance and employer pension contributions.

For example, say you were running a small S corporation that makes $100,000 and that you want to set $40,000 as your S corporation reasonable wage. That leaves $60,000 you pay out as a distribution to your owner—and on which you pay no employment taxes.

That might be risky…

But say the S corporation provides $20,000 of health insurance and a companion health savings account.

In this case, that $20,000 counts as wages (and so bumps the shareholder wages from $40,000 to $60,000) but the extra $20,000 of wages doesn’t increase the employment taxes.

Say you also run either a SEP-IRA or a solo 401(k) plan that provides a 25% employer match. The 25% employer match applies to the $60,000 of wages, which means another $15,000 of nontaxable fringe benefits.

With these fringe benefits, the $40,000 “base” grows to $75,000 of total compensation—though note again only the $40,000 of base wages get subjected to payroll taxes.

If a business makes $100,000 and pays out $75,000 as compensation and benefits, that still leaves another $25,000. And maybe a little risk exists there…

But here’s where a second trick comes into play.

Trick Two: Dial Down the DistributionsThat second trick? If you can, you dial down the distributions to the shareholder. Why does this work?

As noted earlier, an IRS agent can only reclassify as wages those distributions the S corporation pays out (remember in our example that’s the last $25,000 a year).

So, if you leave some of that money (say $2,000 or $5,000) inside the S corporation (as your rainy-day fund or as part of your taxable portfolio), bingo…that money can’t be reclassified as wages.

Another example? If you’re someone who gives to charity (say $1,000 or $2,000 or whatever), you can use some of that $25,000 for your charitable giving. And then that money can’t be reclassified as wages.

Note: When you make charitable contributions from an S corporation, the charitable contribution still ends up on the 1040 return.

To put all this together, a sole proprietorship making $100,000 a year might be able to pay a $40,000 wage, save nearly $8,000 a year in payroll costs, and then remove the risk of an audit by legitimately sculpting the tax return to bump compensation and fringe benefits and dial down the distributions.

Further, this sculpting might be especially compatible with working toward FIRE through aggressive saving and investing.

How Would You Even Do Something Like This?Okay if you operate an unincorporated small business, this all sounds pretty interesting, right?

Sure, some extra work but not that hard to deal with.

So, what’s the next step? Well, if you did want to do something like this, what you would probably do is immediately form a limited liability company.

A limited liability company (LLC) is one of the legal entities that can make an election to use the S corporation tax accounting rules.

The Mad Fientist, on your behalf, arranged for our offices to supply complimentary copies of our DIY S Corporation formation e-book. It provides step-by-step and state-specific instructions for setting up an LLC, getting the LLC an EIN, and then making an S corporation election for the LLC. The DIY kit also includes sample LLC operating agreements. And by the way? Normally, we sell these for about $40. Mad Fientist did you a solid on this! Grab a complimentary kit from this page, Downloadable S Corporation kits… All you need to do to “buy” a kit for some state for free is enter the promo code MADFIENTIST.

Mad Fientist Note: I used one of these kits to set up my Florida LLC and S Corp and it made the whole process super simple. I just followed the guide, line by line, and got everything set up really easily. Thanks to Steve for making these free for Mad Fientist readers and be sure to get your state’s kit before the end of the year because the code will expire on 12/31/2018!

An important point: You need to form the LLC before the new year starts and then file the S corporation election paperwork after setting up your LLC but before March 15th of the year for which you want to use the S corporation gambit.

Example: You might form an LLC today—this very morning or afternoon, for example. But you would file the S election paperwork so it sets 1/1/2019 as the effective date (for 2018, the LLC gets ignored and so your business is treated as a sole proprietorship).

The one other rule to consider: Once you operate your business as an S corporation, you must pay yourself a reasonable salary. And you need to have paid that reasonable salary before the calendar year ends.

Example: If you form an LLC in late 2018 and elect Subchapter S status for 2019, you need to have paid yourself reasonable wages by December 31, 2019. That means paychecks, quarterly federal and state payroll tax returns, tax deposits, etc.

Three Cautions to Wrap this UpLet me issue three cautions before I wrap this up.

First, carefully think through the reasonable compensation math. The S corporation gambit only works well if you can pay yourself a wage that allows you to really save on your self-employment tax bill. Possibly if you’re a one-person independent contractor, you will need to finesse the optics with fringe benefits to get the S corporation to really work safely.

Tip: Usually S corporations don’t work well for side hustles if you have another W-2 job. And usually they don’t work well for businesses unless you’re making high five-figure profits or more.

Second, you should know that two states—Tennessee and California—make the economics of an S corporation option tricky. California levies a 1.5% franchise tax on the S corporation’s profit (the franchise tax also is always at least $800). And Tennessee doesn’t let you use the S corporation accounting for state tax purposes. For these states, you need to double-check your math. The state tax laws may mean the S corporation isn’t viable.

Third, an S corporation’s reduced wages reduce your future Social Security benefits. Now, that effect is usually modest if you pay yourself a reasonable wage. But to really come out ahead on this, you want to save your payroll tax savings.

It’s the Mad Fientist again. Thanks for the post, Steve!

There’s another benefit of having an S Corp that’s worth mentioning…

If your business makes a lot of money (i.e. more than $157,500 for a single person or $315,000 for a married couple filing jointly), having an S Corp could help you qualify for the tax break of the century when you may not have otherwise.

Imagine you’re a single person and your business earns a $250,000 profit next year.

If your business is structured as a sole proprietorship, you wouldn’t receive any Section 199a deduction because you earn too much to qualify.

If you instead have an S-Corp, you’d be eligible to receive a Section 199a deduction on 50% of the W-2 wages paid by your business.

So if you paid yourself 28.5714% of your business profits (which is the percentage that would maximize the Section 199a deductions in this case), you’d be able to get a 20% deduction on $71,428.50 of your income.

This benefit alone could save you thousands of dollars! Throw in the savings on employment taxes described in the post and you can see why this is a great move for many profitable businesses.

If you already have a business, hopefully this post helps you save a big chunk of money on your 2019 taxes (remember, set up an LLC now if you want to make an S-Corporation election for the entire 2019 tax year).

And if you’re just starting your business, hopefully this article gives you an idea of some of the other tax benefits you can look forward to when your business grows!

Related Post Section 199A - The Tax Break of the Century

Section 199A of the Tax Cuts and Jobs Act of 2017 is the biggest tax break of the last 50 years so find out how to take full advantage of it!

The post Why You Should Form an S Corporation (and When) appeared first on Mad Fientist.

Lifehacker

Lifehacker