Michael Burry Trashes Index Funds – Are We Screwed?

As a general rule, Mr. Money Mustache avoids reading the daily news and ignores the fluctuations of the stock market. And he advises you to do the same thing.

The negative factors of wasting your time, diluting your precious brainpower, and creating undue stress by worrying about things outside of your circle of control far outweigh any slight advantages you might get from the tiny slice of news stories that are actually useful and relevant to your daily life.

But on very rare occasions, something will squeeze its way through the News Sphincter that is worth addressing, and last week I learned of one of them. The basic idea was this:

Image source: Bloomberg If you’re not a finance nerd, the phrase “Like Subprime CDOs”, just means “really bad”.

Image source: Bloomberg If you’re not a finance nerd, the phrase “Like Subprime CDOs”, just means “really bad”.

Michael Burry, who in my opinion is a relatively brilliant and well-known financial figure, voiced his concerns that we may be inflating a big bubble by concentrating too much of our money in passively managed index funds.

And because I have been telling you since the beginning that index funds are the best way to invest, my email inbox and Twitter feeds started filling with concerned questions and links to his interview on Bloomberg, asking if we should be taking this seriously.

So is it a big deal? Should we be worried?

The quick answer is No. And we’ll get into the full explanation below, but first let’s do a quick review of Index Funds in general.

Why Index Funds are Great

Index fund investing is both the simplest and the highest performing way to invest your money. It’s as simple as getting any brokerage account and buying the Vanguard Exchange traded fund called VTI, or getting a Betterment account and setting your allocation to at least 90% stocks.

It’s the ultimate win/win because you just set it and forget it. Both the math behind it, and the historical performance for the past 40 years (since the invention of index funds) has proven this out.

Yes, a small percentage of actively managed funds have beaten the market, and a larger percentage have trailed the market. But this over and underperformance itself tends to be random, and today’s winners often become tomorrow’s losers.

A bowl of actively managed funds. Can you pick the winner?

A bowl of actively managed funds. Can you pick the winner?

And here’s the real problem: you can’t predict in advance which of these horses you are betting on. So your best bet is to ride directly in the middle of the pack, while minimizing the fees you pay for the privilege.

But suddenly, Michael Burry says we are reaching the point where this model may soon stop working. So who is right? Mr. Money Mustache or Michael Burry? Have I been naively misleading you?

And what about the reassuring words of Jim Collins in his book The Simple Path to Wealth or rather amusing Guided Stock Market Meditation he put up on YouTube? Is Jim full of it too, in light of these new comments from a financial expert?

Now, we are already treading onto thin ice here, because similar stuff is in the news every day, and most of it is junk. Financial ‘experts’ are a dime a dozen, and just because somebody got something right once (in this case predicting the 2008 financial meltdown), doesn’t mean they will be right in the future.

Because the financial news industry is powered by profits which come from clicks and traffic, their job is to shock and worry and distract you as much as possible so you will click your way through more of their bait. Within the context of that single Burry interview, for example, I saw the following bits of “Breaking News”:

Big gain! (never mind that aside from meaningless fluctuations, the market has gone exactly nowhere in the past nineteen months since January 2018)

Big gain! (never mind that aside from meaningless fluctuations, the market has gone exactly nowhere in the past nineteen months since January 2018)

Down Six Percent! (Oops it was back up to those highs by the time I checked)

Down Six Percent! (Oops it was back up to those highs by the time I checked)

Triple digits! (oh, wait, that is less than a third of one percent because the index is about 27,000)

Triple digits! (oh, wait, that is less than a third of one percent because the index is about 27,000)

Volatility! Impact! (oh wait, that is all just the random fluctuation it always does and it means absolutely NOTHING to you as an investor)

Volatility! Impact! (oh wait, that is all just the random fluctuation it always does and it means absolutely NOTHING to you as an investor)

NONE of these things are the least bit newsworthy, and they shouldn’t even be mentioned in a footnote, let alone labeled “Breaking News.”

So, stock market reporting is silly, and predictions of doom should be viewed even more skeptically. Because the nature of our economic system assures that virtually 100% of predictions of financial doom will always be wrong, because we are not really all doomed – the future is very bright.

However, I’ve read a lot of Mr. Burry’s writing and have more respect for his analysis than that of permanent fearmongers like Peter Schiff or Dmitri Orlov. So I pay attention to his opinions, even when they differ from my favorite permanent realist-optimists Warren Buffett and Bill Gates.

So the summary of his argument is this:

Passive investing tends to distort the prices of individual stocks, because we buy everything in a fixed ratio without considering the value of each company. The “exit door” is small – there is a lot of money invested in fairly small companies whose shares are not frequently traded. So if we all tried to sell at once, we’d have way too many sellers and very few buyers. This would cause a massive price crash in the stock prices of these small companies. There are some complex bits under the hood of index funds – things like options and derivatives that can break under stress and cause money losses or more volatility.

Now at this point, the stock traders and active fund managers are probably cheering and jeering at us:

“YAY! Told you all along – come back to us where you belong.

We are well worth our much higher fees because we are gonna beat the market! Just look at this cherry-picked data from the current ten year bull market!”

But instead of picking a fight, let’s just address these points one by one:

Yeah, but active traders have been making this argument against passive investing forever. The theory is correct, but in practice it would only be a problem if too many of us became passive and there were no active traders left. Thus the real question is: Are we close to this tipping point? And the easy answer is “Not even close”. Index funds own about 18 percent of global shares, and 45 percent here in the US. And active trading still outweighs index fund trades by 22-to-1. A small exit door only matters if everyone is running for the exits at once. And even then, as index fund investors (as opposed to active stock traders), we don’t do that. And even in the event of liquidity problems in a big sell-off, the only downside would be some bigger temporary price swings. We don’t care about those either. To better answer this question, I interviewed some of the people deep inside the machine – Betterment’s investing team and their director Dan Egan. A summary of their thoughts – This is actually more of a problem for “Synthetic” or leveraged index funds, not the true funds we invest in. For the most part, in the index funds you and I use, our money simply purchases real shares of businesses.

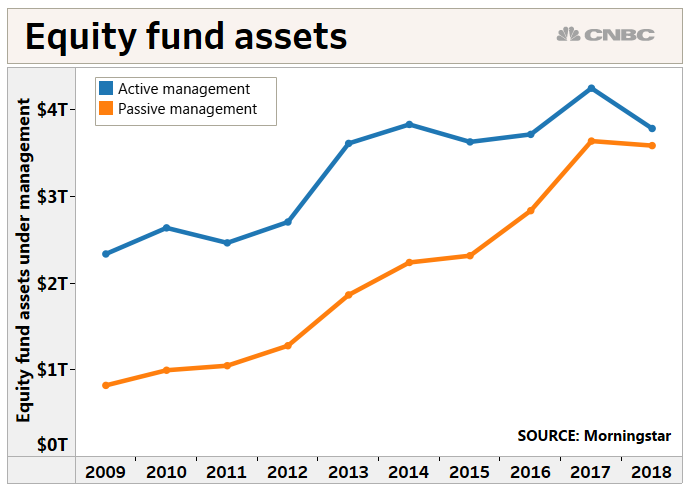

Point #1 above deserves a bit more of an answer. Because the real question here is “how many active investors does it take to balance out a market?” And like everything in life, this is not a black-and-white question. Instead we can look at this as being on spectrum. For reference, this is where we are now:

The great increase in Index fund investment after MMM and Jim Collins started advocating for it :-) Image source – Morningstar / CNBC

The great increase in Index fund investment after MMM and Jim Collins started advocating for it :-) Image source – Morningstar / CNBC

A Purely Active Market…

If everybody was an active investor or speculator, you would just have a sea of squabbling bullshit. Even today, people are trading back and forth for no reason just based on what they think the price will be later this afternoon. Even worse, you have “technical” traders, who place bets on the immediate future of a stock based not on fundamentals, but on obscure (and proven to be useless) mathematical patterns of what the stock price has done in the recent past. I may be unfairly lumping thoughtful value-based investors in here with day traders, but stock price prediction is a slippery slope and most of the trading volume on today’s exchanges is very slippery. And don’t even get me started on the nonsense of “high frequency trading” and the “flash crash” of 2010. No shortage of overly active trading.

If Everybody Was Passive…

At the other extreme of this would be an “All Index Fund” world, where giant zombie-like index funds would just buy all the companies in proportion to their current market value, even when those companies have stopped making money or are on the verge of bankruptcy.

Nobody would be even looking at the earnings, so stock prices would never drop, even when the underlying companies go extinct. And on the flip side of that, companies who became vastly more profitable would never be rewarded with higher share prices.

In this case, a gigantic market opportunity would open up. Apple shares would still be at their 1980 IPO price of 39 cents per share (after accounting for splits), and each share would pay an annual dividend of $3.08, which is like getting a 792% annual interest rate on your investment. Individual investors (even me!) would come back to the market and they would flood in and buy Apple shares, until the share price rose up to a level where supply and demand balanced out. And today, that price happens to be about $216 per share.

There are plenty of people out there, finding and exploiting these little opportunities. People like outspoken tech investor and futurist Catherine Wood speak authoritatively about them – but only time will tell if her $2.3 billion ARK capital fund proves to outperform the market over the long run.

And that is the real answer to question #1: If Actively managed funds start consistently outperforming index funds on average across the entire industry, then we have reached the point of “Peak Indexing”, and you should switch to a good low-fee active fund.

This is far from happening, but I’ll let you know if it ever does.

And for every successful niche-finder, there are a hundred wannabe players, spouting buzzwords and predictions, getting ever-louder when they are right but going mysteriously off the radar when proven wrong. This survivorship bias ensures that if we read the news, we get the mistaken impression that most stock predictors know what they are talking about. They don’t.

So really, that’s all there really should be to stock investing. A small group of dedicated experts seek out the best values, and in a big enough market a larger amount of index fund money can tag along.

Never Forget What Stock Investing Really IS

The value of one share of a company is equal to the “net present value” of all of its future lifetime dividends payable to you the shareholder. Higher expected profits mean higher eventual dividends and thus higher stock prices. Lower profits mean lower prices. And a company that never makes a profit over its lifetime should not even be listed on the stock exchange.

Lower expected interest rates also mean those future dividend payments are worth more of in today’s dollars, which means today’s stocks are worth more. Which is why drops in the interest rate often trigger simultaneous boosts in all share prices.

Some companies don’t currently pay dividends, but that is only because we the shareholders have given the management permission to temporarily reinvest profits into growth – in hopes of larger future dividends.

If we knew (theoretically) in advance that a company would never pay any of its future earnings to shareholders, those shares should be worth zero. A company which never produces and returns value to shareholders is worthless from a financial perspective – unless you could get someone to buy your proven-worthless slips of paper purely on pure speculation, in hopes of selling it to someone at a higher price in the future – like gold and bitcoin. Speculation of this type is a less-than-zero-sum game, a tax on overall human prosperity, which is why you shouldn’t waste your time on it.

So the stock market really is built upon the fundamentals of earnings and dividends. Not on news snippets and soundbites and rapid trading. And since publicly traded companies are big, slow entities with hundreds of employees and thousands of customers, their fates simply don’t change very quickly. “Analysts” who try to predict these future earnings with any certainty rarely outperform a coin toss.

So We Can All Just Stay the Course and Relax

Just as with other bits of news in the financial media, you do not need to take any action. Keep investing and stay the course. If you are so inclined, study up on profitable real estate investments as a side hustle, and if you want a bit of a safety margin in exchange for slightly lower returns in the long run, consider paying off your mortgage as you approach early retirement.

Once you arrive, you will probably find that money and investments are the last thing on your mind. After all, that’s what Financial Independence is all about – becoming free from the need to worry about money.

It’s a nice place to be, and I’ll see you when you get here!

Lifehacker

Lifehacker